Но нужно понимать, что ситуаций с конфликтом интересов у дилера значительно больше, чем у брокера. Дилер, в отличие от брокера, может выступать в качестве контрагента по сделкам клиента. Чем отличается брокер от дилера – ключевой вопрос для любого трейдера.

Какова альтернатива Форекс дилерам

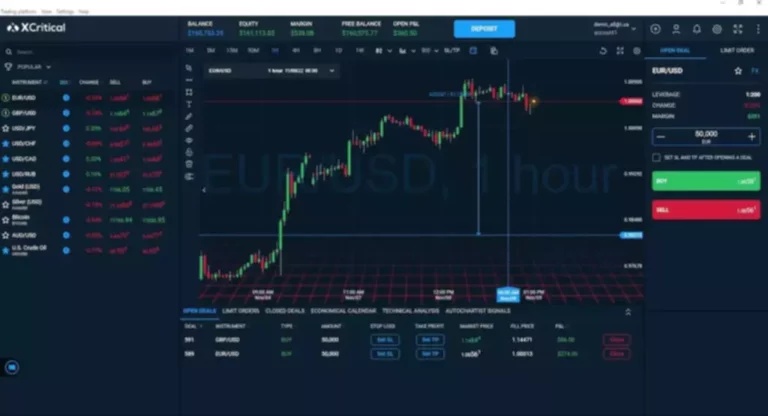

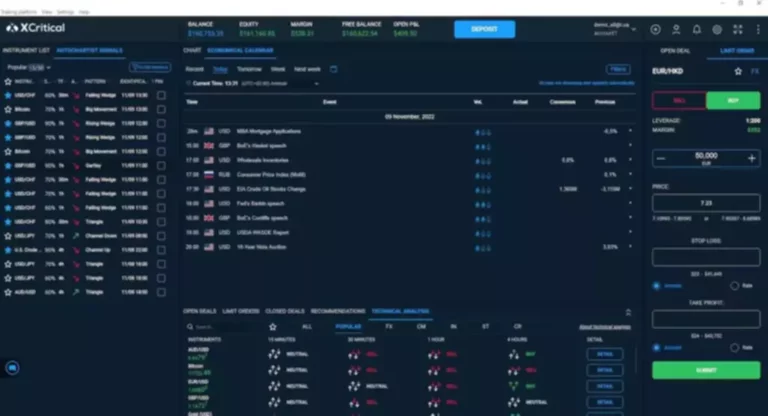

В качестве брокера могут выступать как юридические, так и физические лица. И тем и другим для ведения брокерской деятельности необходимо иметь лицензию, выданную Банком России. Поэтому при обращении к малоизвестным финансовым организациям советуем проверить наличие лицензии на сайте ЦБ РФ. Это может включать в себя вебинары, статьи и видеоуроки, которые помогут трейдерам улучшить свои навыки и знания. Брокер Etcap LTD активно поддерживает своих клиентов, предоставляя доступ к разнообразным образовательным материалам.

А брокер – это посредник между трейдером и рынком, он не принимает решения за трейдера, а просто выполняет полученные указания. Короче говоря, трейдер размещает ордера на покупку или продажу, а брокер исполняет их. Разнице между ценой покупки и продажи (по аналогии с банками, которые при купле-продаже валюты клиентам зарабатывают на разнице курса покупки и продажи).

Управляющий трейдер может быть как профессиональным, так и частным трейдером, который принимает инвестиции для управления ими с целью получения прибыли. Более подробно о деятельности управляющих трейдеров можно почитать в статье посвященной ПАММ-счетам. Бывает так, что одна компания оказывает услуги двух типов, то есть имеет лицензии и на брокерскую, и на дилерскую деятельность. Трейдер может выбрать наиболее выгодную разновидность сотрудничества или разработать собственную стратегию торговли. Перекупщики, как и посредники, получают специальную лицензию на осуществление деятельности.

И именно этот промежуточный этап часто игнорируется в литературе, кино и даже в прессе. Для того, чтобы попасть на фондовый рынок не требуется специального образования, но если вы уже учитесь в колледже, будет полезно пройти курсы по экономике или финансам, а также по бизнесу и продажам. Чаще всего среди брокеров и трейдеров встречаются выпускники экономических, финансовых и математических факультетов. Многие из них окончили физические, биологические и инженерные факультеты. И даже среди гуманитариев, изучавших историю, лингвистику, политологию и философию, есть множество людей, сделавших успешную карьеру на фондовом рынке.

Тест стратегии форекс «Лимитка»: +95,14% по GBP/USD за 12 мес

Брокер, как и дилер, может быть и организацией, и физическим лицом, имеющим лицензию на данный вид деятельности. Дилер действует на свой страх и риск, удачи и поражения влияют только на его собственный кошелек. Он самостоятельно выбирает, с каким именно поставщиком или продавцом он будет сотрудничать, а временной период между договорными отношениями с продавцом и покупателем может иметь достаточно большой диапазон. Брокерской деятельностью может заниматься не только организация, но и индивидуальный предприниматель. В дополнение к этим различиям, нужно подчеркнуть, что стать трейдером может любой человек, однако брокер, как мы уже знаем, должен подчиняться строжайшим правилам и регулирующим структурам.

- Таким образом, отличие брокера от трейдера заключается в том, что брокеры предоставляют свои услуги посредника, а трейдеры занимаются непосредственно торговой деятельностью на финансовых рынках.

- Многие брокеры предоставляют своим клиентам доступ к обучающим материалам и почти все они дают возможность торговли на, так называемом, демо-счёте.

- В этом наблюдается сходство, но разница в том, что посредник получает проценты, в то время как продавец является владельцем полученных денег.

- Два из самых распространенных типов посредников — дилеры и брокеры.

- Старейший в мире фондовый индекс Dow Jones Industrial Average ведёт свою историю с 1896 г., когда его впервые рассчитали на основе курсов акций крупнейших 12 компаний.

Раздел 3: Отличия в способе работы

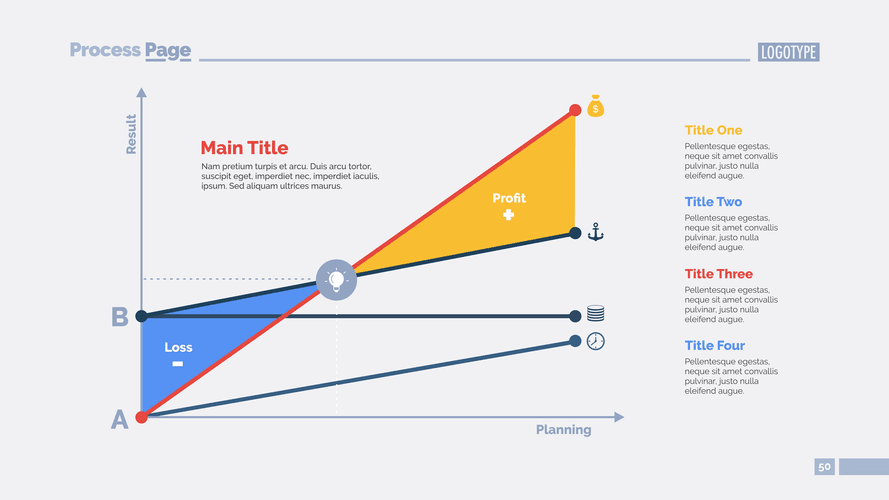

Чем отличается брокер от дилера — ключевой вопрос для любого трейдера. Одна из причин «слитых» депозитов в том, что был выбран дилер вместо брокера и наоборот. Брокер — это организация, выступающая связующим элементом между инвесторами и биржей. Компания дает доступ к фондовому рынку, за что получает вознаграждение от клиентов. Сама она в сделках не участвует, а только выводит на рынок заявки трейдеров.

Чем дилер отличается от брокера на фондовом рынке?

Независимо от того, с кем вы имеете дело, важно понимать их специализацию и роль, чтобы сделать правильный выбор при покупке или продаже товаров. И дилеры, и брокеры обязаны предоставлять клиентам развернутые отчеты о результатах проведенных операций, движениях и остатках активов и денежных средств на клиентских счетах. Хороший посредник (брокеры и дилеры) предоставит клиенту наилучшую цену на бирже, даст выигрышный совет, опираясь на ситуацию в рыночной среде. Брокер не может превышать свои полномочия и выдавать клиенту неправдоподобную информацию о ценовых показателях на бирже. Если брокер осуществил деятельность неправомерно, то за эти незаконные действия его можно привлечь к ответственности.

Как ты видишь, его работа требует знания и опыта, а также способности анализировать и прогнозировать рынок. Дилер может быть и организацией, и человеком, выступающим в роли посредника и формирующим котировки. Дилерские компании тоже выполняют посредническую роль, но их работа имеет отличия от брокерской деятельности.

- Брокеры и дилеры предоставляют своим клиентам регулярную отчетность по всем результатам сделок клиента с ценными бумагами, также предоставляется информация о балансе денежных средств на счету клиента.

- Брокер также является посредником на финансовом рынке, но в отличие от дилера, он действует от имени клиента.

- Стоит обращать пристальное внимание на лицензии, отзывы о работе и на время начала осуществления деятельности, прежде чем доверять поручения.

- В дополнение к этим различиям, нужно подчеркнуть, что стать трейдером может любой человек, однако брокер, как мы уже знаем, должен подчиняться строжайшим правилам и регулирующим структурам.

Функции и обязанности брокера

Кроме того, брокер должен уметь анализировать рынок и предсказывать его движение. Он должен быть в состоянии оценить риски и подсказать клиентам, какие инвестиции будут наиболее выгодными в данный момент. Брокерские и дилерские компании предлагают трейдерам и людям, которые решают брокер и дилер разница инвестировать, информацию. Это может быть лента новостей, данные о состоянии рынков, другие сведения, которые помогают принять решение по поводу совершения сделок. В нашей стране, можно торговать фьючерсами, например, через любого брокера аккредитованного на Московской бирже. Со ста долларами на этот рынок, конечно, не выйти, но и сотен тысяч долларов здесь так же не потребуется.

Между двумя профессиональными участниками рынка ценных бумаг есть значительная разница — и ваш выбор в пользу брокера или дилера напрямую зависит от инвестиционных целей. Если вы собираетесь торговать акциями и облигациями самостоятельно, то вам необходимо иметь брокерский счет. Также он вам понадобится при спекуляции фьючерсами, опционами и прочими деривативами.

Брокеры — это те люди, которые помогают клиентам покупать и продавать ценные бумаги. Они предоставляют информацию о рынке, советуют по разным вопросам и помогают клиентам принимать решения. Главная задача брокера — найти для клиента лучшие возможности для инвестиций и обеспечить выполнение сделок. В своей работе они часто используют связи и имеют доступ к различным биржевым торговым площадкам. Если клиент работает через дилера, то по его усмотрению распоряжения клиента могут реализоваться как на биржевых торгах, так и на балансе самого дилера, и у него есть право выставлять клиентам свои цены. Многие компании в СНГ, предоставляющие доступ к торговле на Форекс и CFD являются именно Дилинговыми Центрами, не смотря на то, что позиционируют себя как брокеры Форекс и брокеры CFD.

В чем разница между брокером, трейдером, дилером, маклером, агентом?

Брокер принимает торговые заявки клиентов и размещает их на рынке, за что взимает определенную комиссию. Таким образом, брокер предоставляет прямой доступ к ликвидности для своих клиентов . Кроме того, участники торгов обращаются к брокерам в целях получения содействия в нахождении покупателей и продавцов тех или иных активов по устраивающей цене. В этом случае брокер, который оказывается способным найти нужного партнера, как правило, получает значительный процент от сделки. То есть максимальный риск клиента дилера — это те средства, которые клиент завел на счет дилера.

Лучшие брокеры Европейского Союза в обязательном порядке обязаны придерживаться норм и стандартов принятой директивы ЕС —MiFID. — компания, выполняющая посреднические услуги между трейдерами и биржами, обеспечивающая совершение торговых сделок на финансовых рынках. Дилер – так же является профессиональным участникам рынка ценных бумаг, который осуществляющая биржевое или торговое посредничество за свой счет и от своего имени. Говоря простым языком, когда Вы торгуете в плюс у дилера, он терпит убытки и наоборот. Так же Дилер зарабатывает на спреде между ценой покупки и продажи.

Он имеет право вести деятельность в любом месте, устанавливать любой процент и условия сделок. Психология успешного трейдера — это сложный и многогранный процесс, в котором дисциплина и эмоциональная устойчивость играют ключевую роль. Выбор надежного брокера, такого как Etcap LTD, может значительно повлиять на успех трейдера, предоставляя необходимые инструменты и поддержку для комфортной торговли. Успешные трейдеры учатся контролировать свои эмоции и не позволяют им влиять на торговлю. Поддержка и образовательные ресурсы, предлагаемые надежными брокерами, могут помочь трейдерам развивать эмоциональную устойчивость и уверенность в своих действиях. Так, брокерский отдел предоставляет доступ к фондовому рынку, консультирует клиентов и поддерживает исполнение биржевых сделок.